New Year’s Eve has a strange energy.

It’s the moment where reflection meets expectation.

Where people feel they should have answers—but often don’t.

That pressure is exactly what leads to unrealistic goals, rushed decisions, and financial burnout by February.

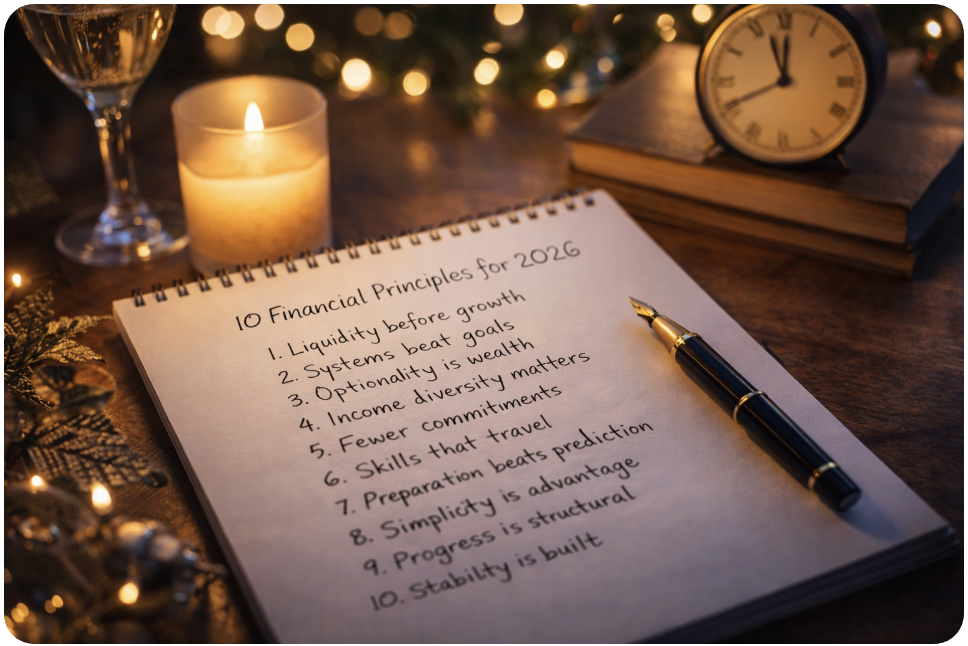

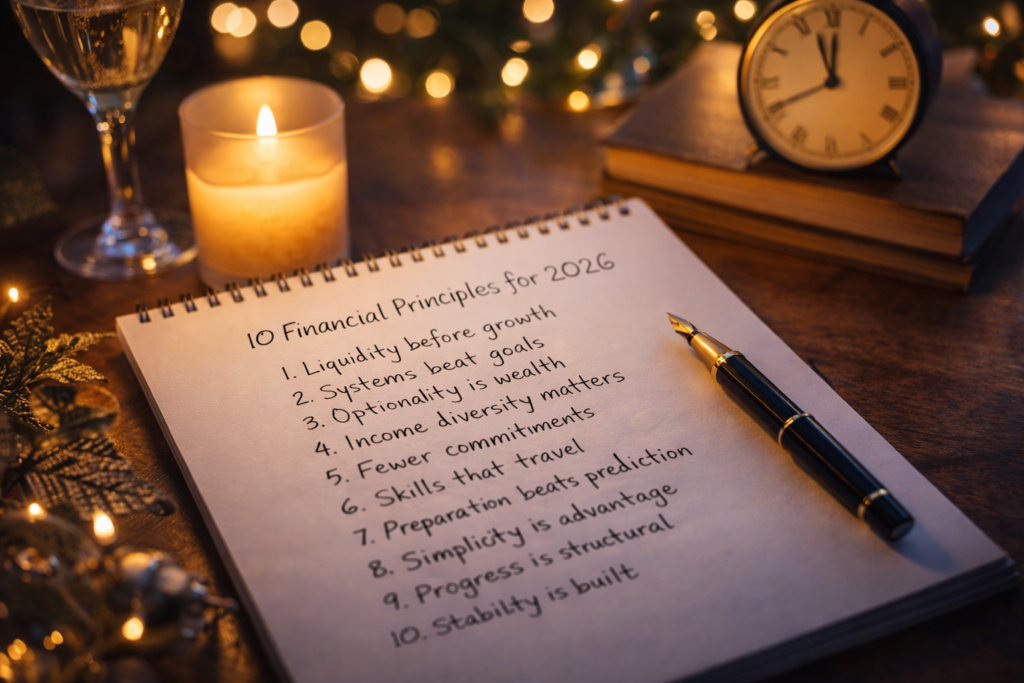

So instead of resolutions, this article offers something different:

Principles — anchors you can carry into 2026 without forcing change.

Principles don’t demand perfection.

They guide decisions quietly, over time.

Here are ten worth carrying forward.

1. Liquidity Before Growth

Before chasing returns, trends, or opportunities, ensure you can breathe.

Liquidity isn’t about pessimism.

It’s about optional time.

When you have liquidity, you:

- think more clearly

- avoid panic decisions

- choose when to act

This mindset reflects the deeper logic behind why financial foundations matter more than performance.

In 2026, calm money will outperform clever money.

2. Systems Beat Goals

Goals expire.

Systems endure.

Goals say: “I want X by December.”

Systems say: “This is how my finances operate daily.”

If 2025 taught us anything, it’s that rigid goals break easily when conditions change.

This is why building systems that adapt matters more than hitting arbitrary milestones.

Design your process.

Results will follow.

3. Optionality Is a Form of Wealth

Being able to say “I don’t have to decide yet” is powerful.

Optionality comes from:

- lower fixed expenses

- diversified income

- fewer irreversible commitments

In uncertain environments, optionality protects you better than optimization.

This idea shows up clearly in how capital behaves before major shifts.

Don’t rush to lock in the future.

Give yourself room to move.

4. Income Diversity Matters More Than Income Size

A large income from one source can feel impressive — and be fragile.

A smaller income from multiple sources is often more resilient.

In 2026, stability will come less from how much you earn and more from how dependent you are on one stream.

This is especially relevant as industries change and relocate, as explored in how economic shifts reshape livelihoods.

5. Fewer Commitments, More Flexibility

Overcommitment is the silent killer of financial stability.

Subscriptions.

Fixed costs.

Long-term obligations.

Lifestyle inflation.

Each one reduces your ability to adapt.

In a changing world, flexibility is not a luxury — it’s protection.

6. Skills That Travel Are Assets

Skills that:

- work remotely

- apply across industries

- solve real problems

- improve with use

…are among the most durable assets you can build.

Unlike roles or titles, skills move with you.

This principle is closely tied to why credentials don’t guarantee security anymore.

In 2026, portability beats prestige.

7. Preparation Beats Prediction

Trying to predict markets, economies, or politics creates stress and rarely improves outcomes.

Preparation, on the other hand:

- reduces downside

- improves reaction time

- increases confidence

You don’t need to know what will happen.

You need to be ready for several possibilities.

8. Simplicity Is a Strategic Advantage

Complexity feels sophisticated.

Simplicity is powerful.

Simple financial structures:

- are easier to manage

- are harder to break

- reduce cognitive load

As explored in why perceived security often hides fragility, complexity often masks risk rather than reducing it.

9. Progress Is Structural, Not Dramatic

Real progress rarely feels exciting.

It looks like:

- slightly better buffers

- fewer bad decisions

- clearer thinking

- calmer reactions

If you expect transformation to feel dramatic, you’ll miss it while it’s happening.

10. Stability Is Built, Not Found

Perhaps the most important principle of all.

Stability is not:

- a job

- a country

- a market condition

- a single asset

It is the result of how your financial life is structured.

This is the quiet conclusion running through everything you’ve explored on this blog — and one of the core ideas behind designing a life that survives change.

How to Use These Principles

Don’t try to implement all ten at once.

Let them:

- sit with you

- influence decisions naturally

- shape how you say yes and no

2026 does not require urgency.

It requires direction.

Coming Tomorrow (January 1)

Article 3 — How to Turn These Principles Into Action in 2026 (Without Burning Out by February)

We’ll explore:

- what to focus on in January

- what to deliberately delay

- how to build momentum gently

- how to measure progress without pressure

Related Resources

- The Foundation: Liquidity First — ETFs, Index Funds, and Your First Real Safety Net

- The Education Trap: Why Degrees Don’t Guarantee Results (And What Actually Does)

- Hidden Opportunities Revisited: Why Capital Moves Before Opportunity Becomes Visible

- My book: How Personal Finance Made Simple Can Transform Your Future